The Importance of Teaching Financial Literacy in Schools

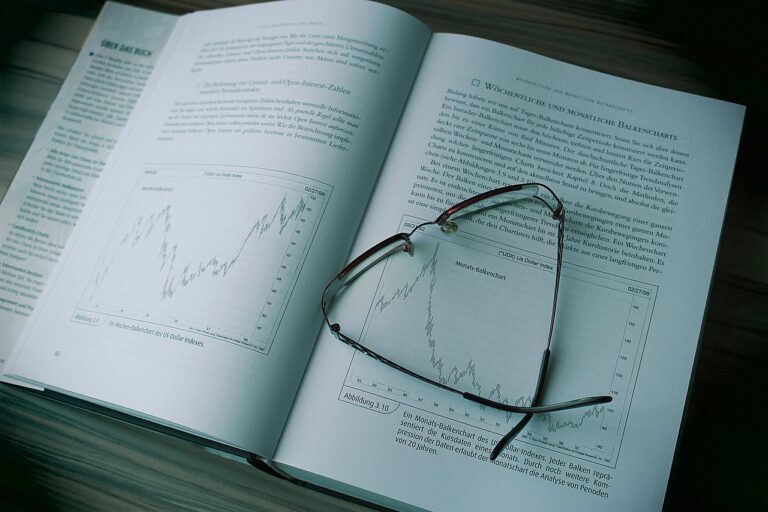

Financial literacy plays a crucial role in shaping students’ future success. When young individuals are equipped with the knowledge and skills to manage their finances effectively, they are better prepared to make sound financial decisions as they navigate through various stages of life. This includes understanding concepts like budgeting, saving, investing, and avoiding debt traps.

Moreover, a strong foundation in financial literacy empowers students to set realistic financial goals and work towards achieving them. By fostering a sense of financial responsibility and awareness early on, individuals are more likely to make informed choices regarding their money management practices. This not only contributes to their long-term financial well-being but also instills a sense of confidence and independence in handling their financial affairs.

The role of schools in preparing students for financial independence

Financial independence is a crucial aspect of adulthood that many individuals strive to achieve. Schools play a significant role in preparing students for this by equipping them with the necessary financial literacy skills. By incorporating financial education into the curriculum, schools can empower students to make informed decisions about budgeting, saving, investing, and managing debt.

Moreover, by educating students about the importance of financial independence from an early age, schools can instill positive money habits that can last a lifetime. Teaching students about the value of earning, saving, and responsibly spending money can help them develop a greater sense of financial responsibility and independence as they navigate through adulthood. By integrating real-life financial scenarios and practical money management skills into the educational experience, schools can better prepare students for the financial challenges they may face in the future.

The benefits of early financial education in shaping lifelong habits

Financial education at a young age can profoundly influence an individual’s financial habits throughout their life. By introducing concepts like saving, budgeting, and investing early on, children develop a strong foundation of financial literacy that can guide their decision-making as adults. Understanding the value of money and being equipped with basic financial skills from a young age can empower individuals to make informed choices regarding their finances.

Moreover, early financial education instills the importance of responsible money management and fosters a mindset of financial independence. As children learn about the various aspects of personal finance, they are more likely to carry these habits forward into adulthood. By cultivating a habit of mindful spending and saving, individuals can navigate financial challenges more effectively and work towards achieving their long-term financial goals.

• Financial education at a young age can profoundly influence an individual’s financial habits throughout their life.

• Introducing concepts like saving, budgeting, and investing early on helps children develop a strong foundation of financial literacy.

• Understanding the value of money and basic financial skills empower individuals to make informed choices regarding their finances.

• Early financial education instills the importance of responsible money management and fosters a mindset of financial independence.

• Children who learn about personal finance are more likely to carry these habits forward into adulthood.

• Cultivating mindful spending and saving habits can help individuals navigate financial challenges effectively.

Why is financial literacy important for students?

Financial literacy is important for students as it equips them with the necessary knowledge and skills to make informed financial decisions, leading to a more secure financial future.

How can schools help prepare students for financial independence?

Schools can help prepare students for financial independence by incorporating financial education into their curriculum, teaching them about budgeting, saving, investing, and other important financial concepts.

What are some benefits of early financial education in shaping lifelong habits?

Early financial education helps students develop good financial habits from a young age, such as saving, budgeting, and avoiding debt. These habits can lead to greater financial stability and success in the future.